tmrw

Defense Is The Best Offense

Jan 8, 2026

Defense is the best offense in 2026.

The markets delivered yet again in 2025. Four out of the last five years have produced excellent returns. It’s been life changing for millions of Americans.

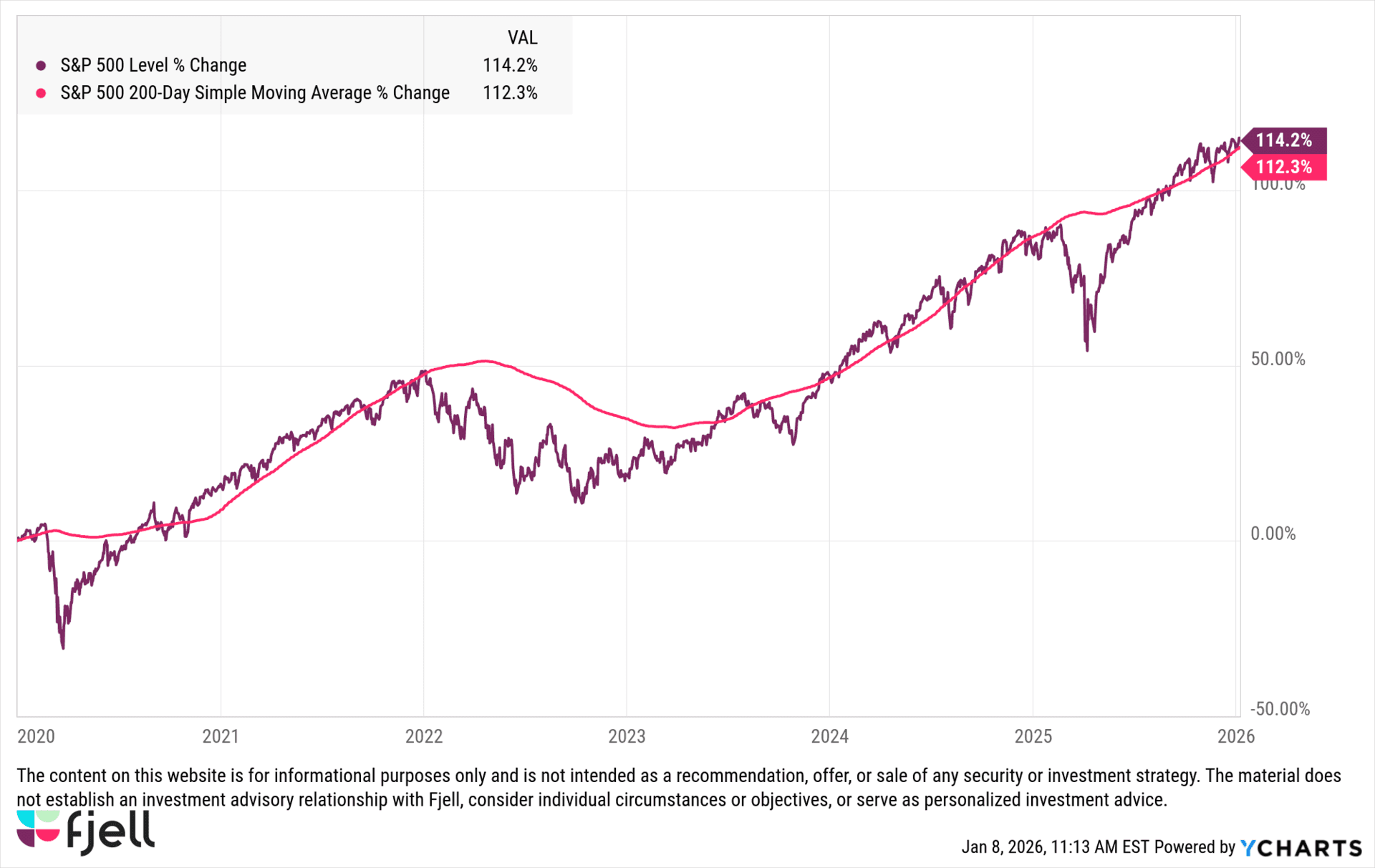

The chart of the S&P 500, six years into this decade, is downright beautiful.

S&P 500 Cumulative Return and it’s 200 Day Simple Moving Average

The risk takers have been rewarded handsomely, which is precisely why now is the perfect time to remind you that keeping those gains should be high on your priority list.

In 2026, you can win by not losing.

You see, markets are priced for perfection at the moment. The AI role out is happening. The Fed’s plans are being hampered by a strong US economy. Things are good right now.

We’re on the mountaintop I wrote about just a few weeks back, but the mistake people will make right now is assuming that because markets are working, nothing needs to change.

Flows Before Pros

There’s an old saying on Wall Street: flows before pros.

It means this: pay less attention to what people say, and more attention to what they actually do with their money.

Put another way: do as I do, not as I say.

So instead of giving you a long list of things to optimize as the year starts (there’s plenty of that out there right now), I want to share something simpler.

Here are a few things not to do in 2026, this is my personal list, not because I expect trouble.

Because I don’t want good markets to lull me into complacency.

This list is where the gains of the first half of the decade can slowly leak off your balance sheet.

What not to do:

Letting Inflation Reshape Your Life Without You Noticing

Inflation is still here and it arrives differently if you are at peak consumption years. House repairs, college tuition, cars, insurance premiums are all heading in one direction – up and to the right. Lifestyle creep. Every dollar you spend, you need to make two to replace it. This one is big in my household right now to understand and control.

Assuming You’ll Have Time to Act Later

Interest rates are lower, the US economy is growing, markets move fast, deglobalization is happening, these all shape how markets move. The winds of opportunity are both smaller and larger, you need to move with precision and speed (example, executing a Roth conversion in the right market windows). Modern markets move fast, I want to move with them.

Treating Taxes as a Once-a-Year Problem

My tax planning is already in motion from the work we did in December with my team. Taxes, as you know, are a major source of drag on your financial life, the IRS has given us an entire year to be intelligent about them. I will be working throughout the year to better my situation.

Mistaking AI as a theme vs a transformation

The AI roll out, as I mentioned above, is happening, and we, as investors, have somewhat of a clue about what it means for our economy, our retirements and our portfolios. Up until this point, it’s been great but what I am committed to doing is assuming this will be the largest technological innovation in my career, and treat it as such. There’s big risk, and big upside.

This isn’t rocket science. None of these in a vacuum will break you overnight, but mistakes compound just like money.

And this is what those mistakes eventually turn into.

Time is what creates money.

Financial mistakes often don’t show their full consequences for years, sometimes decades. When the impact is delayed or muted, it doesn’t always prompt action at the moment it matters.

I saw two large groups of investors last year as I talked with prospects and readers: those who were swinging for the fences in AI and those who were paralyzed with fear.

The group swinging for the fences in the AI boom seem to forget the fact that concentration is both a way to get rich fast and become poor quickly. You don’t need to swing hard at all times.

The group paralyzed by fear were oblivious to the fact that the economic equivalent of the automobile or electricity may be unfolding before our eyes, and opportunity is vast at the moment.

The people in the middle slept well at night.

My dad was clear as he taught me this business after spending 25 years giving counsel to hundreds of families across the country, he said “Tom, the answer is almost always someplace in the middle.”

If you’re stuck in fear, or constantly swinging for the fences in your 401(k), what you stand to lose isn’t just money.

It’s time.

And money needs time to grow.

“Tom, check this out”

I was wrapping up year-end planning with my CPA when she mentioned a tax and trust strategy that fit well with what my wife and I are working towards.

It was late in the year and we needed to move quickly due to the required coordination between the various different organizations involved. We brought in our attorney and pushed it through before year-end.

I knew about this trust structure, but not the specific state tax ramifications. We quickly deducted this was something for my family. The tax savings were meaningful.

My team told me I needed to move, and I did.

We wanted me to be the test case before bringing it to clients in 2026.

I value charitable giving. I understand that paying taxes is part of living in a great country. I just don’t want to pay more than I should when the tax code clearly rewards planning.

Now we’re adjusting our tax and giving strategy for 2026.

That’s what good defense looks like.

You lose when you overpay.

You lose when the people around you stop paying attention.

You lose when you assume things will always stay the same.

The easiest way to win in 2026 is not to lose.

Tom

Want More?

Here are some of our most popular posts.

Retire Wiser

Join the 24,000+ investors who read tmrw each Thursday.