tmrw

Effective Beats Interesting

Jan 15, 2026

U.S. large caps are, in some ways, the municipal bonds of equity investing.

They are boring, they are obvious, and historically, they’ve been extremely effective investments.

The mistake people make is confusing “boring” with “risk” or “lack of returns”.

They assume U.S. Large Cap Stocks are the equivalent of “driving an old Honda” and that duplex your colleague wants to go in with you on, or the hot, local private lending deal, is the equivalent of a new Porsche 911 for your wealth. Smoother, faster, sexier, and more exhilarating.

When you think about your portfolio though, you don’t get paid to be interesting, or novel, or sexy, you get paid (literally) to be effective.

You want to get the big things right.

That means being directionally right with your allocation.

It means being tax-efficient across your entire financial life.

And it means making sure the foundational building blocks actually do foundational work.

Much has been written about the growing dominance of U.S. large caps across the global stage, even more so, about the dominance of the top 10 stocks in the index, which makes up a staggering 30% of the S&P 500.

You know the names: Meta, Amazon, Apple, Microsoft, Nvidia, Broadcom, etc.

The concentration is real, but don’t write them off.

This week, I am going to walk you through why the U.S. large cap space could potentially continue to win disproportionately big, why they are misunderstood, and why we continue to allocate heavily in the space at Fjell.

You Ain’t Seen Nothing Yet

Bachman-Turner Overdrive penned this song over 50 years ago. They clearly weren’t writing about U.S. Large Caps, but thus far, that’s the song the asset class has been singing back to us.

What makes large cap stocks hard to understand from the vantage point of portfolio construction is their sheer size. They employ tens of millions of people, their products and services are everywhere. As individual investors, it’s easy to jump to “I can’t control the narrative, I am at their whim, how can Walmart double from here” and look elsewhere.

And for decades, looking elsewhere did produce better returns. Small caps, throughout much of the 20th century, did outperform their large cap brethren.

But the internet, and the technology born from it in the 2000s, has changed the game.

Here in 2026, U.S. Large Caps are having a well deserved moment.

Here’s their current edge:

Scale has become their advantage, not a constraint – Apple, in 2023, bought a new company every 1-2 weeks. Google has 9 businesses with over 1 billion users. Berkshire Hathaway is a free cash flow machine with its diversified portfolio. Where scale once meant ceiling, it now means opportunity. Modern business is complex, an average data center has $1 billion+ worth of chips in them. Data centers are being built everywhere. The capital required for this is massive. Little companies have a hard time competing against this scale.

They attract the best people – the best and brightest in the world consistently choose to work at their companies. Companies are nothing more than a group of people working together on shared projects. U.S. corporations have been, are, and will be the equivalent of all star teams. There have been generations of people raised up in them and they now possess a skillset honed by experience, generating returns. Entire organizations have been trained to consistently produce profits. J.P. Morgan makes (profits) ~$150m every day. They do that, in part, by their ability to attract, reward, and retain the best talent in the world.

The best talent within strong governance – but you can’t just put a bunch of talented people together and expect them to run together in a consistent direction that creates value. That’s where governance comes into play, the U.S. is home to the some of the best capital markets, regulatory environments, but more than that, there is a common belief that governance is important and protecting what we’ve built is importance too. But talent and governance alone doesn’t the economic miracle of churning out $50 billion companies like the U.S. has. They are well run and in fact have turned the regulatory environment into a business moat they can profit from.

Entrepreneurism is the base case – Nvidia just spent $20 billion hiring a team of developers that effectively knocked out one of their potential competitors vying for a slice of their market. The story circling around is Jenson Huang, CEO of Nvidia, recently met with the founder of Groq. Both knew the game that was being played, and just a few weeks later, a deal was announced, a $20 billion deal. Stuff like this, the speed at scale, is unique, and highlights how quickly and good we have it here in the states. While this story is about two billionaire CEOs doing a deal, entrepreneurship is America. U.S. Large Caps, in 2026, can move fast, at scale, and relocate capital in a way that you and I simply cannot.

Priced for Perfection, but look at them – a common theme among those skeptical of this space look back at history see how companies were cheaper back in the day. They look back at the 80s and say “large caps traded at X multiple”. True, they did, and this was what an office looked like in 1985: no internet, no email, no data centers, no AI. Companies today are simply better businesses. A friend of mine is a business analyst at a large tech company, responsible for analytics on a segment that does over a billion in revenue. Over dinner, we were talking about AI and work. He told me the last 18 months have been the biggest change in how he does his job in his 20‑year career. That kind of transformation is worth something. The speed, the depth of analytics, and the ability to put real‑time insights directly in front of the C‑suite all help management make better decisions for shareholders. Yes, large caps are expensive. But in this market cycle, they’ve earned their premium.

U.S. large caps represent the pinnacle of business.

Any company, if they were that good, would reach these ranks, but of the roughly 6 million businesses with employees in the U.S., only 500 of them are in the S&P 500.

It’s estimated that the total value of privately held companies in the U.S. is somewhere between $14-15 trillion, a substantial amount, but the value of the S&P 500 is ~$62 trillion.

Seeing these numbers is when the common objection of, “well this is the peak, I am going to look elsewhere to find great investments, how more can these companies possibly grow from here?” There are real estate deals, private equity deals, secondaries, the list of ways to invest has literally never been bigger.

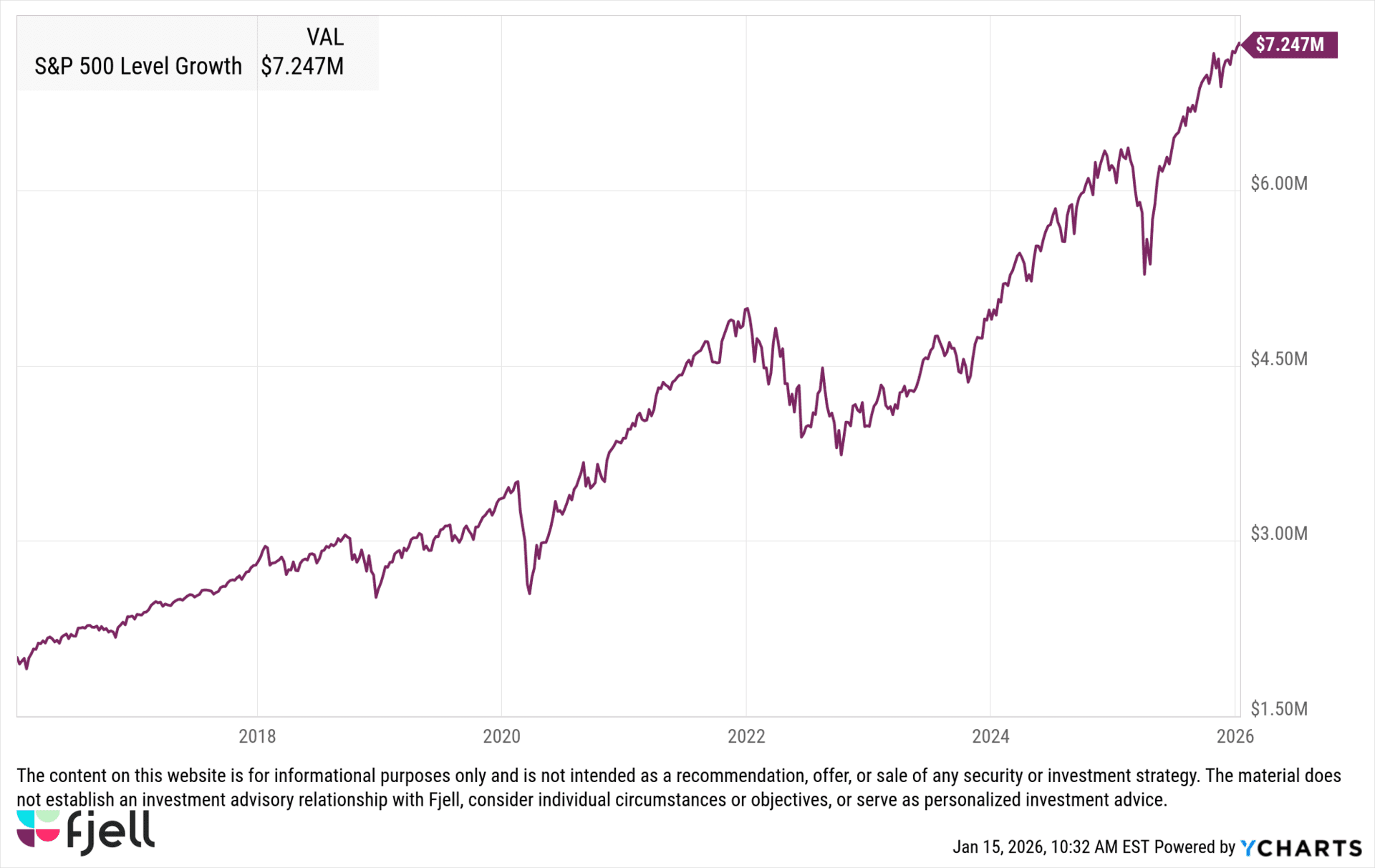

This chart has answered a lot of questions over the past 10 years, I don’t know what the next 10 years are going to be, but I would think it would be something like this?

10 Year S&P 500 Returns on a $2 million Investment

The question I’ve always asked myself, and for clients, over the years, when presented options to invest, is this:

“How is this better than U.S. Large Caps?”

Not different.

Better.

Call me naive, call me unsophisticated, call me whatever you want. I’ve read the pitch decks, been in the meetings, seen the deals, and that’s the question I keep coming back to.

“Well that was a nice reminder”

The bar that U.S. large caps sets for everyone is ridiculously high.

I was on Goldman’s website last year and they kindly reminded me they had over 1 million job applicants in 2024.

When you fundamentally go back to what you are trying to accomplish with your money, it’ll boil down to something like this: I need steady returns that produce cash flow.

Alternatives to U.S. large caps fail because investors underestimate how hard, how long, how complex and how much it costs to grow faster than the S&P, particularly in 2026.

There is no shortage of “better” opportunities on paper, from a duplex on the other side of town, to a private deal to purchase car dealerships in Missouri, to thousands of publicly traded investments here in the U.S.

When you walk away from assets like U.S. Large Caps because they feel obvious, you’re probably missing the point.

I have, for years, judged my personal net worth growth, my business growth, our equity strategies, investment opportunities based on U.S. large caps.

They are the standard and the foundation.

The standard is not complicated either.

Coke has sold the same recipe for a hundred years.

Microsoft is still selling Office Products.

Boeing still builds airplanes.

Basic, repetitive, yet effective.

Thanks for your time this week.

See you next week.

Tom

Want More?

Here are some of our most popular posts.

Retire Wiser

Join the 24,000+ investors who read tmrw each Thursday.