tmrw

The Tax Shift

Oct 16, 2025

We just got the 2026 tax brackets last week.

I wouldn’t say there was anything groundbreaking in there, just the customary adjustments to the income limits.

Circle back here if you want to check them out after you read this edition.

A lot’s been written about taxes this year. With the passing of the Big Beautiful Bill over the summer, there’s been no shortage of opinions. But rather than rehash what’s already been written, I want to show you something practical: how tax efficiency actually works.

Tax efficiency is how you structure your investments to pay the least amount of tax legally required, compared to other methods that achieve the same goal.

Last week, I mentioned that while financial complexity can feel frustrating, it often signals an opportunity for tax planning, and tax planning is the work that creates more tax efficiency.

But like great investments, great tax planning opportunities do not show up at your doorstep every day. And like great investments, the rewards compound over time, giving you more freedom to do what you want later in life.

To understand this better, let’s look at how your tax life evolves as you move toward retirement.

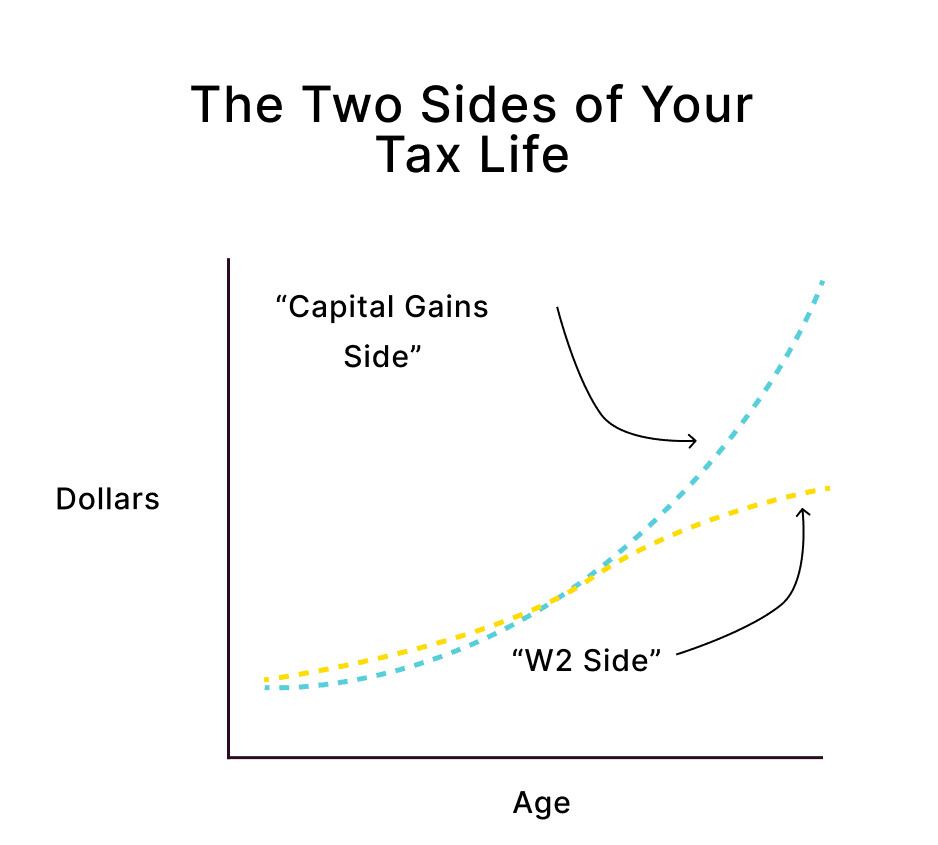

At some point, your financial life splits into two different tax worlds:

the W2 Side and the Capital Gains Side.

The W2 side is straightforward. It reflects the taxes you pay on your income from work, the world of federal income tax brackets.

As your assets grow, the Capital Gains side begins to take over. Think dividends from stocks and ETFs, long-term capital gains, and interest income.

In retirement, this Capital Gains side becomes your tax life.

There are two main reasons:

You no longer have employment income.

Your assets now produce the income you live on.

As you can see in the chart above, that shift happens quietly at first. The divergence is small, but over time your investments become your entire tax life.

When you miss opportunities to structure your assets more efficiently, you end up with less money. More precisely, you send bigger checks to the IRS instead of booking flights to see your grandkids.

If you miss this transition and reach 75 with a $3 million IRA, wishing it were split into a $1 million brokerage account, a $1.5 million IRA, and a $500,000 Roth, there is not much you can do. The only way forward at that point is to pay a lot of tax to get to a better spot.

Let’s keep going.

I rarely see this clearly laid out.

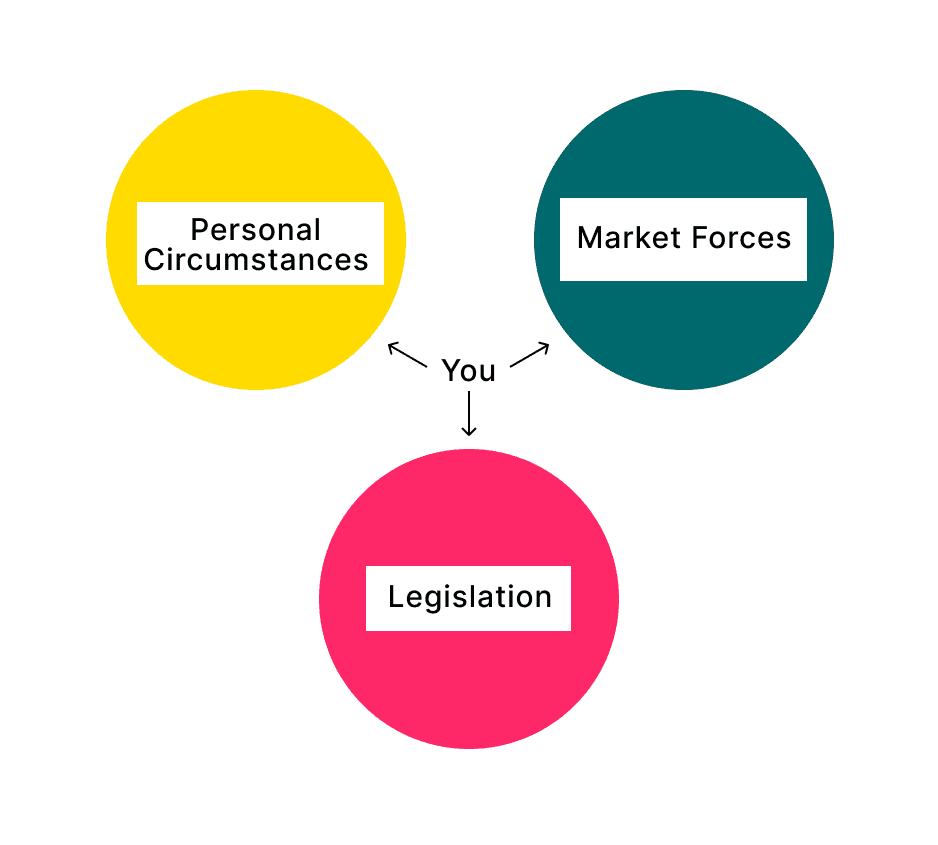

Before I get into the three different levels of tax planning, I want to show you where tax planning opportunities come from. Take a look at this simple diagram I made:

Drivers of tax efficiency

You are always at the center of your financial life. You are your biggest asset and, at times, your biggest liability. It pays to know where to look for opportunities.

Here are some examples:

Your Personal Situation — selling a business, facing large medical expenses, or receiving an inheritance.

The Market — when markets move sharply up or down, they can create opportunities for you to make positive tax changes.

Legislation — as we saw with the rush of estate planning over the past year, new laws and uncertainty around the tax code often drive major planning activity.

All three forces will continue to shape your tax life. When legislation creates major opportunities, the market often amplifies them, and your personal situation determines how you can act.

Now let’s talk about the three different levels of tax planning.

Level 1 — This is where most people operate. It includes optimizing documents for your CPA, reviewing year-end deductions, and making salary deferrals once the basics are covered. These are helpful, but reactive. If you stay at level one, you’ll miss out on the ocean of opportunity the IRS has laid out for you.

Level 2 — This type of planning digs deeper into how you’re taxed. It includes tax-efficient investing, backdoor Roths, HSAs, and Roth conversions. This level is about optimizing what you already have, balancing both the short and long term, and moving assets into the right types of accounts to compound your tax efficiency.

Level 3 — These are the rare, strategic moves that shape your entire financial foundation. Examples include starting or selling a business, retiring, inheriting wealth, or experiencing a major life event that opens a unique window. For example, we had a client who was deployed to the Middle East a few years ago. Their income dropped during deployment, and we helped the family complete Roth conversions at a historically low tax bracket. This is where the money is made.

Most people understand Level 1 almost by default. But if you think back to the $3 million IRA example from earlier, you only reach a better balance sheet later in life if you and your advisors go deeper into Level 2 and don’t miss Level 3 opportunities.

“Cool, Tom, this sounds great, but I’m 62. Seems like the ship has passed.”

Not exactly. Remember, the sources of tax efficiency come from three places: the market, legislation, and personal circumstances.

Sure, if you’re in your 60s or 70s, there are simply more life events in the rearview mirror that you can’t change. But as your assets grow, there are still plenty of opportunities to increase your tax efficiency.

I was recently in my attorney’s office with my wife, updating our estate plans. While meeting with Kyle, I found myself exploring that Level 3 foundation in my mind and in conversation. I was thinking, imagining, and dreaming about how to fold my kids into our financial life, how to benefit them with the way we’ve structured our business and investments, and how to do it all in a tax-efficient way.

I’m a long way from having an estate tax problem. My kids are all under six. But I know that conversations with my personal team of advisors now can create a huge impact later—on my family, in our community, and in the causes we care about.

And yes, it also means less tax revenue to the government, in a completely legal way.

Nothing major came out of that meeting, but I walked away with a clearer picture of what I can do, and what I should do, in the years ahead. My team and I are now working on a plan for my own finances to get me closer and more prepared for when significant level 3 opportunities show themselves.

I understand that it’s my job to look for opportunities and dream out loud with our personal team of what I want to happen, and it’s their job to help me make that a reality.

And how did I end up getting here? My attorney asked us to come in and update our estate plan. I listened, and we’re better off because of it.

Simple as that.

Building a better version of your financial life, and planning for life after your career, takes time and intentionality, and saying yes to people who exist to help you. It’s about doing the basics well before you pull the trigger and retire.

Take your time. Do the basics well. Strategize with your team. And don’t forget about the Level 3 opportunities.

Thanks for reading this week,

Tom

Want More?

Here are some of our most popular posts.

Retire Wiser

Join the 24,000+ investors who read tmrw each Thursday.