tmrw

Recessions, Rate Cuts, and Reality

Sep 25, 2025

The Federal Reserve is trying to avoid a recession.

The Federal Reserve, led by Jay Powell, exists for one reason: to keep the U.S. economy from sliding into recession.

They do this by controlling short-term interest rates (the Fed Funds Rate), managing Treasury Bond purchases and sales (Quantitative Easing or Tightening), and signaling what they plan to do (Forward Guidance).

To visualize this work over the past 10 years:

Purple Line: Fed Funds Rate || Pink Line: Assets Held by the Fed

As you probably know, the Fed just cut rates again by 0.25 percent. While 0.25 percent sounds small, it’s worth understanding why the Fed is continuing with rate cuts and how that affects your portfolio.It should come as no surprise that money is lost in recessions:

People lose jobs, and with them, personal incomes.

Companies lose revenue and cut expenses (jobs, R&D, marketing, etc.) to maintain profitability. That in turn causes other businesses to lose revenue and cut expenses.

Investors lose because the companies they invest in are worth less.

The government loses because when unemployment rises and profits fall, tax revenue falls.

The Federal Reserve was created to minimize the odds and the impact of such events.

What makes recessions especially difficult is that they are extremely hard to predict.

Here’s an example of how one almost started:

Earlier this year, President Trump, just minutes after markets closed on April 2, announced from the Rose Garden at the White House new tariffs on every country across the globe. No one was spared. It was unprecedented. Markets and economists were bracing for tariffs, but not for that.

Wall Street’s response?

“We are immediately in a recession.”

Investors fled the markets in anticipation of the effects.

Five trillion dollars in value was erased from the S&P 500 over the next two trading days and volatility spike to levels we hadn’t seen since Covid.

VIX since January 1, 2020

We all know what happened next. The administration backtracked, then backtracked again, markets rallied, and we equity markets now sit at all-time highs.

We avoided a recession, thankfully, but got a taste of what they look and feel like in the mid-2020s.

For investors, especially those nearing the final stretch of their careers, recessions can hit hard. You can experience a dual blow: loss of income from a layoff and a significant decline in your portfolio’s value.

Recessions and their effects on your financial life, both near and in retirement, are worth understanding. It’s not a question of if you will face one, but when, and how it will affect you.

The Federal Reserve knows this. Like the markets, they try to stay ahead of it all to protect people and institutions across the U.S.

Business / Investing / Economies / Careers / Life all take place in cycles.

The Federal Reserve’s policy stance can be viewed in cycles as well.

Here’s a zoomed-out chart of there policy moves going back to 2000. The gray bars represent U.S. recessions. Notice how interest rate policies shift around recessions, as does the Fed’s asset level.

Purple Line: Fed Funds Rate || Pink Line: Assets Held by the Fed

With history in hand, here’s how the Fed has managed the economy this decade, pulling us out of recession, taming inflation, and bringing us to where we stand today:

2020

In response to the pandemic, the Fed cut rates to zero and, along with the U.S. Treasury, infused liquidity to support families (stimulus checks), small and medium-sized businesses (PPP loans), and offered transparent policy communication to soothe investors.

Late 2021

A year and a half into the pandemic, the writing was on the wall. Liquidity from the U.S. government and the Fed was fueling inflation. Out of nowhere, we were contending with price growth not seen since the late 1980s. The Federal Reserve shifted its stance, preparing people for interest rate hikes.

2022–2023

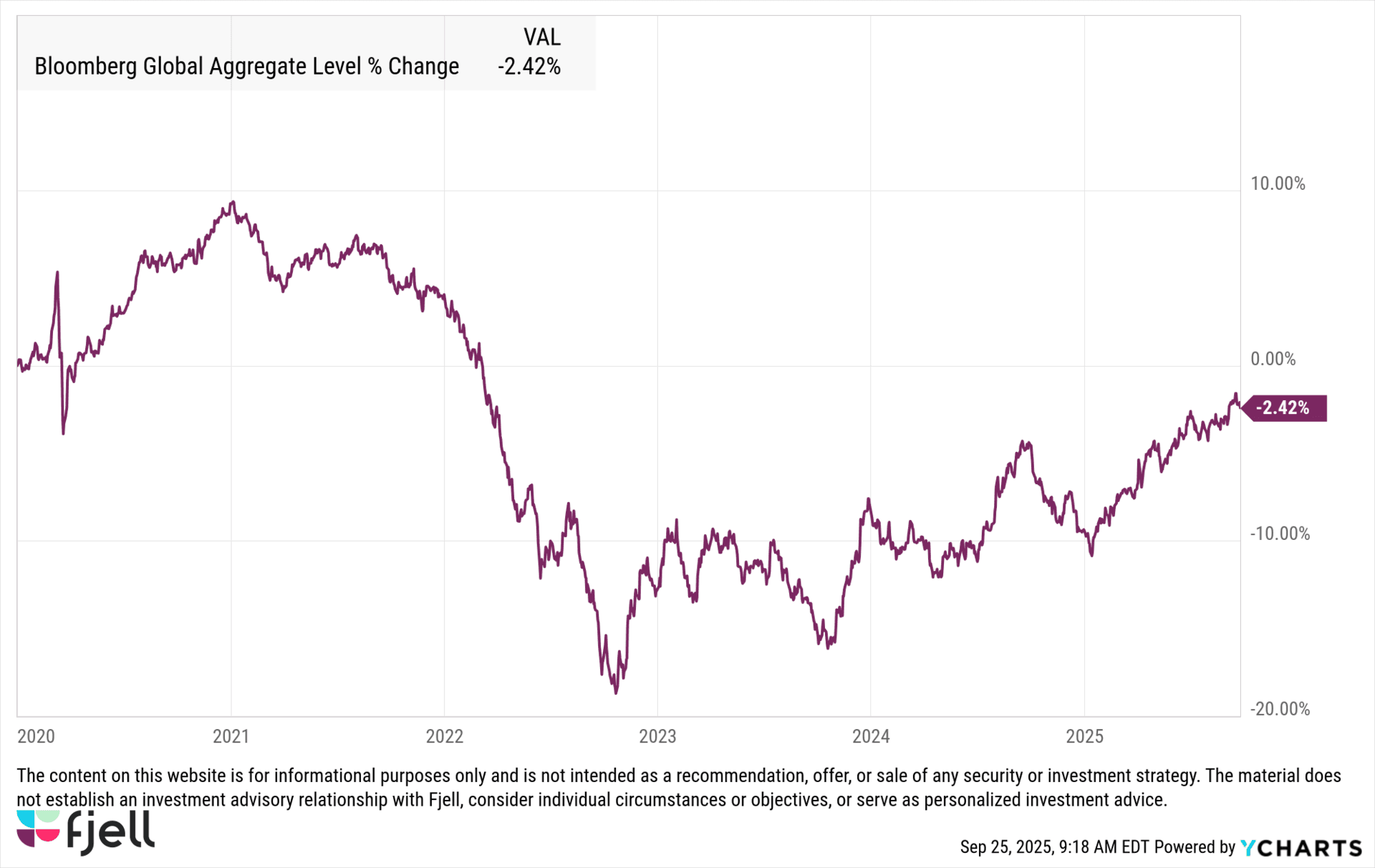

With inflation surging, peaking at 9.1% in June 2022, the Fed began its fastest rate hike cycle in history. Investors of all kinds ended 2022 nursing losses and wondering what lay ahead.

2024

By mid-2024, the Fed had reached the limits of its hiking cycle, pausing at 5.5% for 14 months. They adopted a “wait and see” approach, letting the economy and investing community absorb the data. By September, the rate-cutting cycle began.

2025

Which brings us to today, with the Fed declaring victory over inflation while now contending with a cooling labor market.

Through this rate cut to hike to now cut, three things have happened in your portfolio.

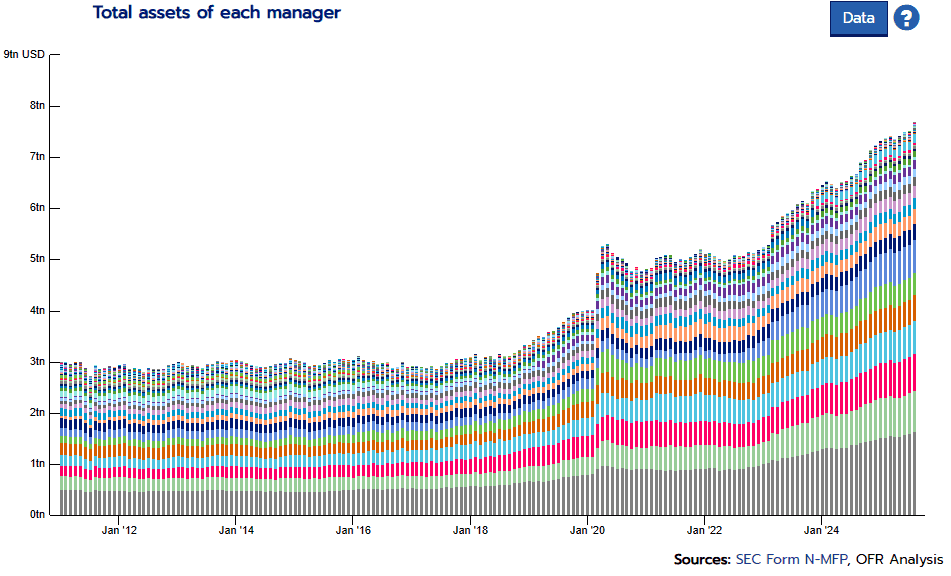

Cash finally paid you again– After years of earning nothing, cash finally produced returns. CDs roared back to life, money market funds exploded, and investors earned income from cash after more than a decade of zero.

Bonds cratered, now have room to recover– The hikes of 2022 created one of the worst bond markets since the 1800s. But with interest rates now higher, there is far more room to generate meaningful returns in fixed income.

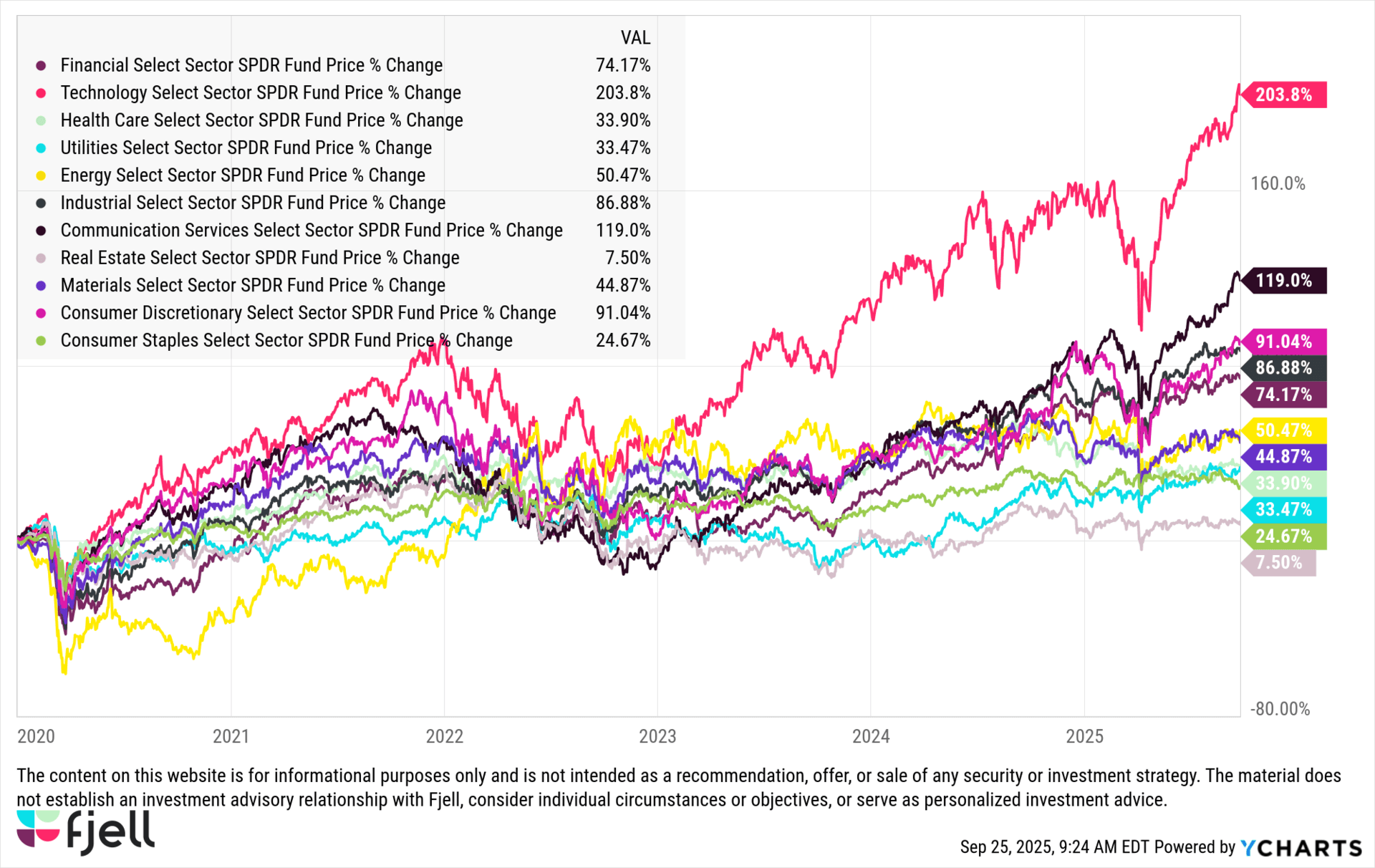

Stocks soared, powered by AI– While the U.S. economy is holding steady, the real driver has been AI. Without the AI boom and its gold-rush moment, the market would likely look far weaker. The general economy is fine, but the AI economy is on fire.

At every step of the way, as you prepare for retirement, the Fed moves preemptively in ways that deeply affect your assets and strategy.

Here are things that historically happen as the Fed continues its rate-cutting cycle:

Bonds – While long-term yields are driven by market demand, they typically follow rate cuts over time. That should lift bond prices.

Credit – Rate cuts ease borrowing costs. If you need to use debt vs invest in it, costs to borrow will likely drop.

Equities– Markets are historically volatile around rate cuts (see 2008 and 2020). This cycle looks different from those, but volatility should still be expected.

Cash – Record amounts remain parked in money market funds. As rates fall and yields decline, that money will need to move elsewhere. Wherever it flows will likely see higher demand and rising prices.

The bottom line?

Understanding the Fed is not just economics. It is about managing your own risk and recognizing opportunity as policy and markets shift. Each cut reshapes the landscape and tells a story. Pay attention, move proactively, and know that I will be here to keep you updated.

As always, this is only a snapshot, not the whole story. I hope it gives you clarity to make smarter decisions as the Fed continues its cutting cycle.

Tom

Want More?

Here are some of our most popular posts.

Retire Wiser

Join the 24,000+ investors who read tmrw each Thursday.